Roth Conversions Explained: A Guide to Tax-Free Retirement Income

- Holzberg Wealth Management

- Aug 20, 2025

- 9 min read

Updated: Aug 21, 2025

Table of Contents Navigation

|

When it comes to retirement planning, one of the most common questions people ask is: How can I keep more of my money in retirement and less of it going to taxes? One of the strategies that has gained popularity in recent years is the Roth conversion. While the name may sound technical, the concept is fairly straightforward: you take money from a pre-tax retirement account, like a traditional IRA or 401(k), and move it into a Roth IRA. The catch? You pay taxes on that money now so that later, your withdrawals can be completely tax-free.

For many people, Roth conversions can be an excellent way to create flexibility and reduce uncertainty in retirement. But like most financial strategies, it is not a perfect fit for everyone. Let’s break down what Roth conversions are, why people use them, and what you need to think about before deciding if one makes sense for you.

What Exactly Is a Roth Conversion?

To understand a Roth conversion, it helps to compare the two types of retirement accounts. With a traditional IRA or 401(k), you generally contribute money before taxes and get an upfront tax deduction for doing so. The account grows tax-deferred, but when you retire, you pay ordinary income taxes on every dollar you withdraw.

With a Roth IRA, you contribute after-tax dollars. The account grows tax-free, and qualified withdrawals in retirement are not taxed at all.

A Roth conversion simply means moving money from a tax-deferred account (traditional IRA or 401(k)) into a Roth IRA. However, the IRS will not let you do this for free – the amount you convert is treated as taxable income for that year. But the trade-off is that once it is inside the Roth, your money can grow and be withdrawn tax-free.

Why People Choose Roth Conversions

With conventional tax planning, the standard advice has been to take advantage of what is often called a “tax bracket arbitrage.” While you are working and in a high-income bracket, the idea was to contribute to a Traditional IRA or 401(k), get the deduction now, and then withdraw the money later in retirement when you’d presumably be in a lower tax bracket.

Tax Bracket Arbitrage

That strategy still makes sense for many people – but it is not universal anymore. If you are a strong saver or have built significant wealth in pre-tax accounts, your future withdrawals could actually push you into higher brackets during retirement. Add in the uncertainty of future tax law changes, and it becomes clear that planning only for today’s bracket may leave you with a bigger lifetime tax bill.

Modern tax planning still optimizes for minimizing taxes this year, but it also looks at the bigger picture: reducing your total taxes over a lifetime. The goal is to find balance – getting upfront tax benefits now without creating even bigger tax problems later. Roth conversions play a key role here because they allow you not just to pay taxes at today’s rate, but to create flexibility and control over how much of your retirement income will be taxable in the future.

The main attraction of a Roth conversion is the promise of tax-free retirement income. Imagine reaching retirement and knowing that no matter what happens with tax law or your income needs, the money in your Roth IRA is yours to spend without worrying about taxes. That peace of mind alone can be worth a lot.

Another significant benefit is flexibility. Traditional IRAs and 401(k)s require you to start taking minimum withdrawals in your 70s, whether you need the money or not. These required minimum distributions (RMDs) can create large tax bills later in life. Roth IRAs, on the other hand, do not have RMDs during your lifetime. That means you decide when (and if) to use the money, giving you more control over your tax picture.

Roth conversions are also a way to hedge against future tax increases. If you think your tax rate will be higher in retirement – either because your income will rise or because tax laws will change – converting now allows you to pay taxes at today’s rate and avoid potentially higher taxes later.

Lastly, Roth IRAs can be a powerful estate planning tool. Unlike traditional accounts, which saddle heirs with taxable withdrawals, Roth IRAs can be passed on tax-free, helping you leave a more efficient legacy. They can also reduce the size of your taxable estate, since taxes are paid upfront rather than by your heirs later.

When Does a Roth Conversion Make Sense?

There is no single formula that makes a Roth conversion right or wrong – it depends on your situation. That said, there are a few scenarios where conversions tend to be especially attractive.

One common time is during low-income years. For example, if you retire early but have not yet started Social Security or required minimum distributions, your taxable income may temporarily drop. Converting during those years allows you to “fill up” the lower tax brackets at a relatively cheap cost.

Filling Up Tax Brackets

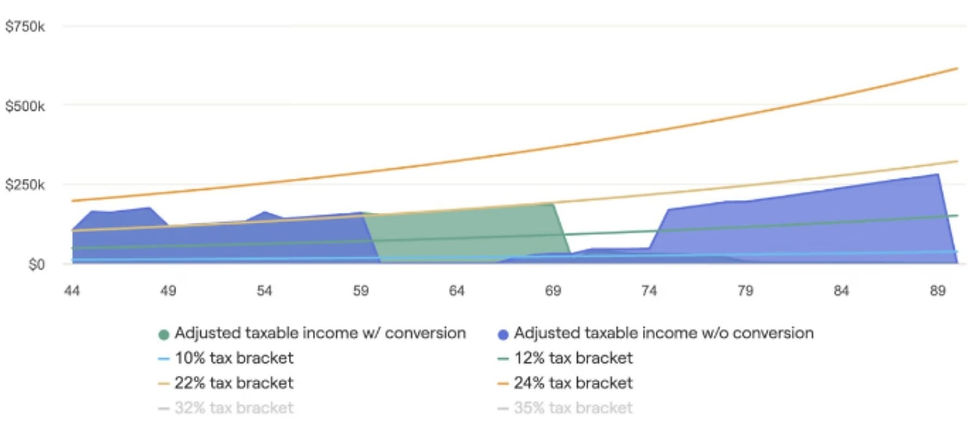

In the chart above, you can see the trajectory of someone’s income projected over their lifetime. The blue shaded area represents taxable income without Roth conversions, and the horizontal colored lines show the current tax brackets. Notice the dip in income during the early retirement years – before Social Security and RMDs begin. By strategically doing Roth conversions during that dip, you can “fill up” those lower brackets. The idea is to pay a little bit of tax at lower rates now to avoid paying a lot more tax at higher rates later. Over time, this can significantly reduce the total taxes you owe across retirement.

Another opportunity can come during market downturns. If your IRA has dropped in value, converting at that lower balance means you pay taxes on a smaller amount. For example, imagine you have a $200,000 IRA invested in stocks. If the market drops 20%, your balance might fall to $160,000. If you convert at that time, you only pay taxes on $160,000 instead of $200,000. When the market eventually rebounds, that growth happens inside the Roth IRA – which means it is now tax-free.

Younger savers can also benefit. If you are early in your career and expect your income – and tax bracket – to rise over time, paying taxes now at a lower rate can pay off in the long run. Not to mention taking advantage of those additional years of compounding growth in a tax-free account.

And for those thinking about the next generation, Roth conversions can ensure your heirs inherit tax-free assets rather than accounts that will trigger income taxes when withdrawn – potentially pushing them into higher tax brackets.

Important Considerations Before Converting

Of course, there are trade-offs. The most immediate is the tax bill. A Roth conversion adds to your taxable income for the year, and if you convert too much at once, you could push yourself into a higher bracket. For this reason, many people choose to do partial conversions over several years rather than all at once.

Another key point is how you will pay the taxes. Ideally, you want to pay the tax bill from money outside the retirement account. Using IRA funds to cover the taxes reduces the amount that actually gets converted and could even trigger penalties if you are under age 59½.

It is also important to remember the five-year rule. Withdrawals of converted funds are subject to a five-year waiting period (or until you reach 59½, whichever comes later) before they can be taken out without penalties. That means Roth conversions are generally best suited for long-term retirement planning rather than short-term cash needs.

NOTE: The five-year clock for Roth conversions does not start on the day you move the money. Instead, it begins on January 1st of the calendar year in which the conversion takes place. For example, if you convert funds on May 1st, 2025, the holding period is treated as starting on January 1st, 2025. Keep in mind that each separate conversion has its own five-year timeline, so if you convert in multiple years, you will be tracking more than one start date.

Example 1: Early Withdrawal Penalties Suppose someone in their mid-50s converts $10,000 to a Roth IRA. If they withdraw part of it just two years later, before meeting the five-year requirement and before age 59½, they could face a 10% penalty in addition to taxes on the withdrawal. |

Example 2: The Five-Year Rule for New Accounts Consider someone who opens their first Roth IRA at age 58 and converts $7,000. By 61, the account has grown, and they take out the full balance. Even though they are over 59½, because the account hasn’t been open for five years, the growth portion of the withdrawal could still be taxable. The good news: they would avoid the 10% penalty. |

And do not forget about state taxes. Depending on where you live, a conversion could trigger not just federal but also state income tax.

Another factor to be aware of is Medicare premiums, which are tied to your income through something called IRMAA (Income-Related Monthly Adjustment Amount). A large Roth conversion could push your income above one of the IRMAA thresholds, raising your Medicare Part B and Part D premiums for the year. Careful planning around these brackets is essential, especially for those nearing or already on Medicare.

Strategies to Make Roth Conversions Work for You

Roth conversions are not an all-or-nothing decision. In fact, some of the most effective strategies involve spreading them out. A partial conversion strategy – moving a portion of your IRA each year – allows you to better break up the tax liability over time, rather than take one large tax hit.

It is a good idea to work with your financial advisor and tax preparer to implement effective tax bracket management, converting just enough each year to stay within your current bracket without spilling into a higher one. This is often called taking advantage of the tax planning window – the period after you stop working but before you begin Social Security and RMDs. During these years, your income may be relatively low, creating opportunities for tax-efficient conversions.

A Roth conversion can also be particularly effective during a market pullback, when account balances are lower. You pay tax on the depressed value, and when markets recover, the growth happens inside the Roth.

The Bottom Line

Roth conversions can be a powerful way to create tax-free retirement income, reduce required distributions from pre-tax retirement accounts in your 70s, and give yourself more control over your financial future. But they are not for everyone. The right decision depends on your tax situation, your retirement timeline, and your long-term goals.

Because the tax implications can be significant – affecting not just your tax bracket but also Medicare premiums, Social Security taxation, and more – it is wise to run the numbers before moving forward. A financial planner or tax professional can help you design a conversion strategy that makes sense for your unique situation.

If done thoughtfully, a Roth conversion can be one of the most impactful retirement planning strategies available – turning today’s tax bill into tomorrow’s financial freedom.

Need help figuring out how Roth conversions fit into your financial plan? Reach out, we're here to help you make the most of your retirement and charitable giving needs. You can schedule a complimentary, no-obligation call with us here.

If you liked this post, please share it and let us know if you have any comments or questions!

About the Author

Holzberg Wealth Management is a family-owned and operated financial planning and investment management firm based in Marin County, CA. As your financial advisors, we serve you as a fiduciary and are fee-only, so we never receive commissions of any kind. We help individuals and families like you in the greater San Francisco Bay Area and nationwide with the financial decision-making process to organize, grow, and protect your assets.

** This writing is for informational purposes only. The author and Holzberg Wealth Management do not guarantee or otherwise promise any results that may be obtained from using this report. No reader should make any investment decision without first consulting their financial advisor and conducting their own research and due diligence. These commentaries, analyses, opinions, and recommendations represent the personal and subjective views of the author and do not constitute a recommendation, offer, or solicitation to make any securities transaction. The information provided in this report is obtained from sources that the author believes to be reliable. External links to third parties are being provided for informational purposes only. Holzberg Wealth Management is not affiliated with the third-party websites linked to, unless otherwise explicitly stated, and does not constitute an endorsement or approval by Holzberg Wealth Management of any of the third party’s products, services, or opinions.